By David Lamb CFP™ MCSI

English philosopher and statesman Sir Francis Bacon famously once said ‘Money is like manure, of very little use except it be spread’.

And how you ‘spread’ the risk of your investment portfolio is crucial if it is to be of future use.

Historically, stock market investments provide good longer-term returns but as most people are aware investing in shares does have its risks.

To reduce these risks, measured by volatility, investment portfolios will not just put money into the stock market but will consider other assets such as cash, fixed interest securities (bonds) and property, depending upon the target level of risk of the portfolio.

The lower the risk, the more will be invested in cash and fixed interest securities. The higher the risk, the greater the weighting in equities.

Another aim of investing in a range of asset classes is to achieve negative correlation between these investments. When one asset class falls out of favour, another will attract investments (the money must go somewhere!)

To understand the benefits of negative correlation, let’s assume that last August when temperatures were very hot you decided to invest in ice cream. The sales pattern of ice cream will be high in the summer but low in the winter.

You do not want to have all your eggs in one basket, so you decide to spread the risk by investing in something else, suncream. The problem with this is that both commodities will sell in a similar way throughout the year.

If you invested in Wellington boots, when sales are likely to be higher the winter and lower in the summer, you will achieve negative correlation with your ice cream.

If the equity market falls, often investors will expect money to flow out of the stock market and into fixed interest securities because they are usually lower risk and returns would normally be expected to be higher than putting the money in the bank.

Therefore, funds such as Vanguard and BlackRock that offer asset allocations of 40% fixed interest and 60% equities have been so successful; they also have very competitive charges.

But we live in strange times!

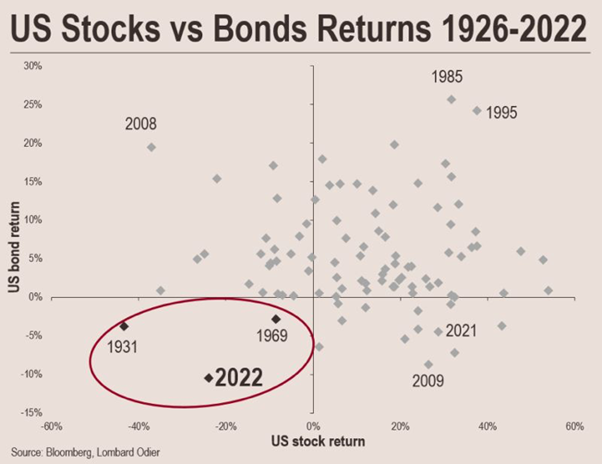

The following chart shows the correlation between the US stock market and US bonds between 1926 and 2022. In almost 100 years, there have only been three years when both asset classes have provided negative returns – the last more than 50 years ago.

While the current market turmoil is extremely rare it is therefore not unique.

This year we have experienced inflation hitting a 40-year high, governments reversing monetary policy, the ongoing pandemic, the supply chain problems caused by the COVID lockdown in China and Russia’s invasion of Ukraine, which of all 26 wars in Europe since 1945 has had the biggest impact on world economies.

It is likely that we will continue to suffer this economic pain for some time, but eventually we will come out the other side and things will improve.

In the meantime don’t panic and if you have any concerns about your investment portfolio please do not hesitate to contact us at enquiries@lambfinancial.co.uk or by calling 01661 860438. Hopefully, we can provide some reassurance.