Many people think that financial planning just involves buying financial products such as pensions or investments.

I have not met many people who really want to buy a pension; what most people really want from their money is to be able to achieve and maintain their desired lifestyle without the fear of running out of money – whatever happens.

To help our clients to do this, we have to know how much is enough. How much money do they need support this lifestyle?

To help us calculate ‘enough’, we need to understand what our clients’ lifestyle looks like. For many, especially if they have not given much thought to what they would like their lifestyle to be, this can be quite difficult.

Most financial plans will include income, expenditure assets and liabilities, but the lifestyle financial plan needs to consider the components of a balanced lifestyle that I have discussed in recent articles.

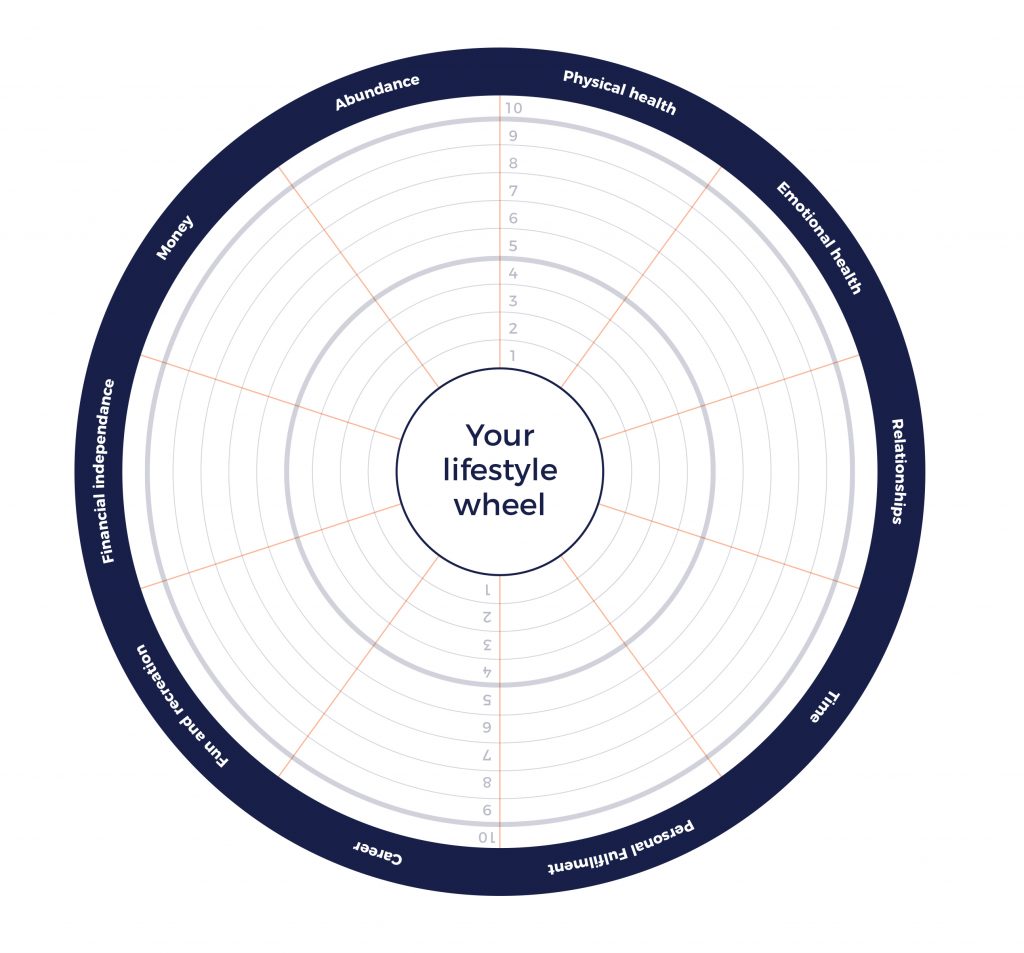

To help our clients achieve this, I developed our ‘lifestyle wheel’. This helps clients understand where they feel they are now with the lifestyle and identify areas for improvement.

Give yourself a score, on a scale of one to 10 where one is low and 10 is high, for each component of your lifestyle. Then join the dots.

If you have a good balanced lifestyle, you will have a nice big round circle. You may score low but have a nice round wheel, but this probably means you are in for a bumpy ride!

Any buckles in your wheel will suggest areas for improvement. If you need to improve your lifestyle, think about why you have given yourself that low score, what you can do to improve it, when are you going to take action and what the financial implications are.

We can then build these into a cash flow model round which we can create your financial plan which will help you achieve, and maintain, your desired lifestyle – whatever happens.

Give it a go; it could change your life!

Client case study

Jack and Jill (not their real names) owned a guesthouse. Running the business involved working seven days a week, 50 weeks of the year.

When they completed their lifestyle wheel, they scored really low on time and fun and recreation. We looked at how we could create more time and more fun but unfortunately, due to the margins in the business, there was no ability to take on more staff to give them more time off.

We eventually came to the conclusion that the only way we could find more time was to sell the business.

The business was to go for sale when they reached 55. The business would be sold for £800,000 but unfortunately the sale of the business meant the sale of their home out of the proceeds. We therefore needed to buy a house for around £300,000.

The big question was, is £500,000 at age 55 enough? Enough to give Jack and Jill the lifestyle they want without the fear of running out of money, whatever happens. And it wasn’t.

The next question was how much did they need to earn between age 55 and 67? Using our sophisticated cash flow modelling software, we calculated that, between them, they needed to earn £12,000 a year over the next 12 years.

As Jack pointed out, that was only two days a week each, working in a supermarket and five days a week to themselves.

They are now time rich and don’t need to worry about money!

If you would like more information or advice on lifestyle financial planning contact Lamb Financial at [email protected] or by calling (01661) 860438.