By David Lamb CFP™ MCSI

It does not seem so long ago that we were in the middle of a pandemic and inflation was only 0.3% (November 2020).

The reason inflation was so low was down to the lockdowns, when we could only really buy essentials; we could not go the pub or restaurants, go on holiday or even have a haircut.

This resulted in the second quarter of 2020 recording the highest level of savings on record at 23.9% of disposable income or £140bn. The average for the previous decade was 8.5% (source: Office for National Statistics/ONS).

When the lockdowns were lifted, this money gushed through the economy, increasing inflation to 3.9% by June 2021.

The Bank of England has an element of control over this inflation. Increasing interest rates makes the cost of borrowing more expensive, effectively taking money out of the economy, so people have less to spend which therefore reduces demand.

This can, initially, seem good news for savers, as they will experience higher returns on their deposit accounts. But the bad news is for those whose investments hold fixed interest bonds such as gilts, where the capital value is likely to fall.

Many investment funds use fixed interest product to offset the volatility of equities. If you hold a cautious managed type of fund, you will likely hold fixed interest investments.

Of course, the interest rate on deposit account is not the real rate of return on those investments. The real rate of return is the interest rate minus inflation.

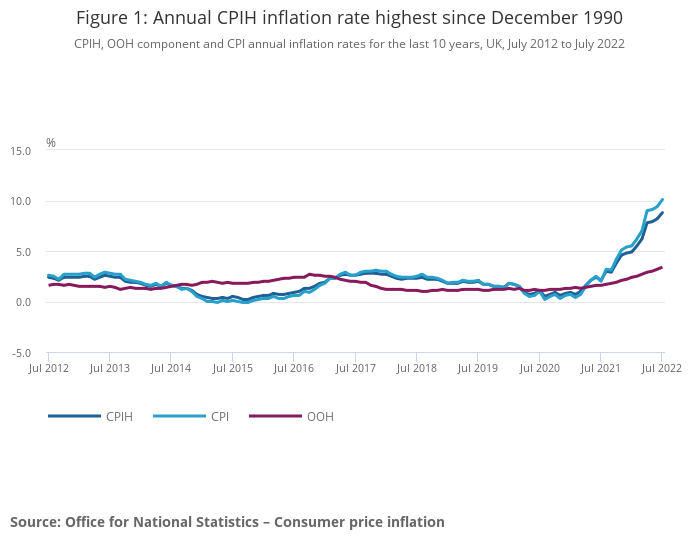

The current rate of inflation (latest figures are for the 12 months to August 2022) is 9.9% (Source: ONS).

According to Moneyfacts, the best one-year fixed rate deposit account is paying 3.3%. That is a real return of -6.8%!

And on September 9 investment bank Citi warned that it expects inflation to hit a 50 year high of 18.6% early in 2023.

The causes of the current inflationary pressures have changed since the end of lockdown and now include the higher prices of goods we buy from abroad. Businesses are charging more because they face higher costs and there are more job vacancies than there are people to fill them, meaning employers are having to pay higher wages to attract new applicants.

The highest price rises over the past year include fuel at the forecourts (+43.7%), transport (+15%), food and non-alcoholic beverages (+12.7%) and housing/household services (+9.1%).

However, the major cause of the current high inflation is the cost of energy. Russia’s invasion of Ukraine has led to the price of gas more than doubling since May this year, with Vladimir Putin being accused of weaponizing energy.

We are effectively at economic war with Russia.

Everybody is aware that the following winter is going to be tough, but let’s look to the positives: at least it is an economic war, the Government is intervening to freeze household energy costs and the Bank of England is forecasting inflation to be back to its target of 2% in around two years.

If you are concerned about the longer-term effects of inflation on your wealth, please seek professional advice. In my next blog, I will look at the possible consequences of high inflation to investors.