By David Lamb

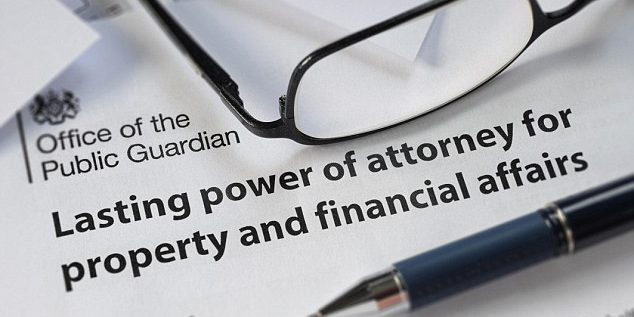

Most of us do not want to do think about our loved ones – or ourselves – losing mental capacity and many people think ‘it won’t happen to us, we’re fine’. But what would happen to our finances if this were to happen?

Effectively the Court of Protection comes along and puts a padlock on that person’s finances, and they and their family lose control of their money.

Cheques can’t be written, money can’t be transferred, and bills cannot be paid. A deputy is appointed and so starts a long and expensive process.

The key to that padlock is a lasting power of attorney, but you can only buy that key when you have mental capacity. Once that is lost it is too late.

BBC Radio 4’s personal finance show Money Box featured the rules for taking care of some else’s finances in their programme last week. You can listen to it via the following link:

https://www.bbc.co.uk/sounds/play/m000sh8v

I strongly recommend that you consider establishing lasting powers of attorney whilst you still can before it’s too late. You never know what is around the corner…