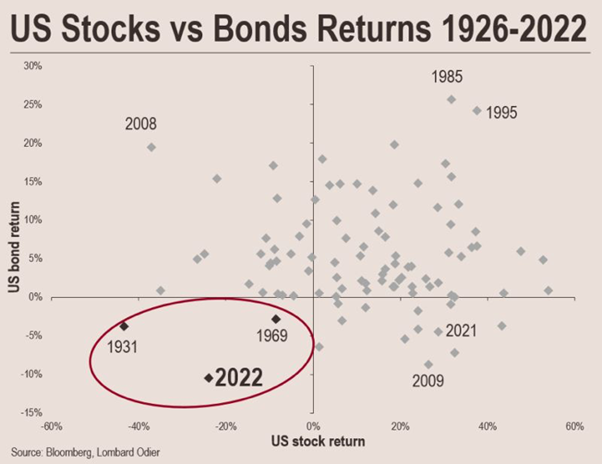

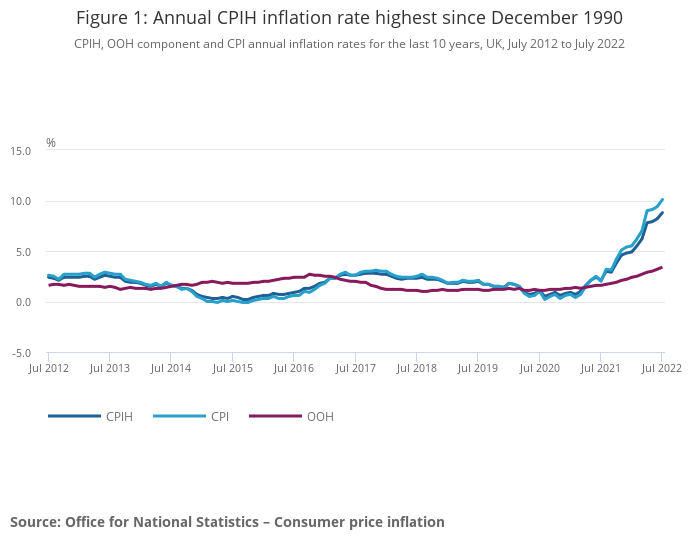

After a day of global market turmoil yesterday, with hundreds of billions of pounds wiped off the value of the FTSE 100, our latest markets factsheet advises how maintaining a diversified portfolio and focusing on long-term goals can help cushion such short-term shocks.

Click on the image to download: